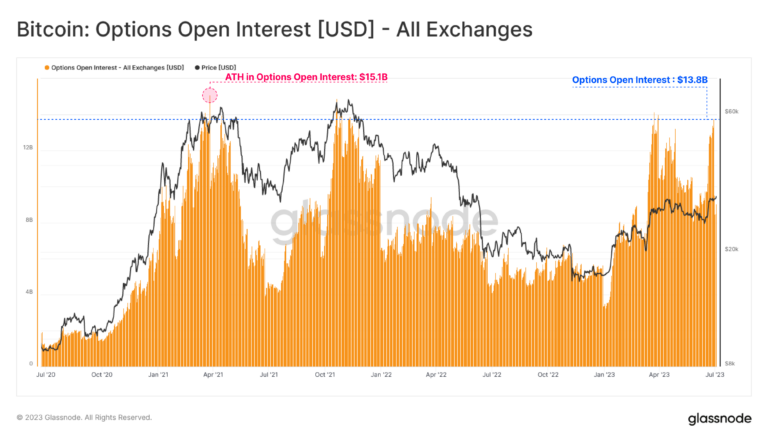

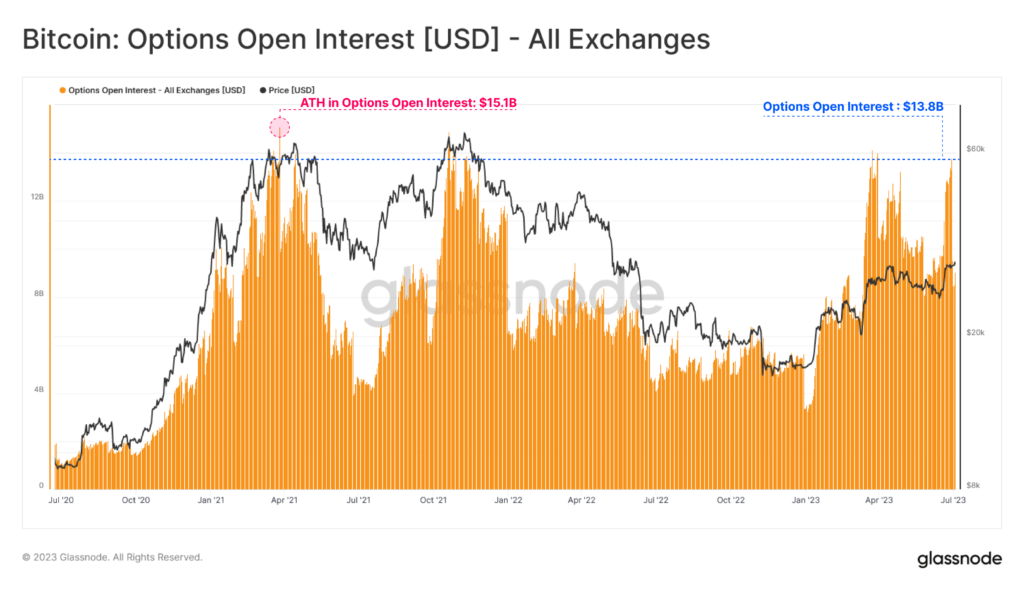

In the ever-evolving landscape of cryptocurrency, Bitcoin continues to dominate the market. As the demand for Bitcoin and its associated investment vehicles grows, Bitcoin Options Contracts have emerged as an attractive choice for market investors. Glassnode reported Open Interest in Bitcoin Options Contracts recently surged to a staggering $13.8 billion, indicating a significant increase in investor appetite for risk-defined derivative instruments. This article explores the reasons behind this surge and examines whether it marks the beginning of a new bull market. We delve into the distinctions between call options and put options, helping investors navigate this complex terrain.

Bitcoin Options Contracts Experience Soaring Open Interest

The popularity of Bitcoin Options Contracts has skyrocketed in recent times, with Open Interest reaching $13.8 billion, a mere $1.3 billion away from the all-time high of $15.1 billion. This surge in Open Interest suggests that market investors are actively seeking risk-defined derivative instruments to gain exposure to Bitcoin. By using options contracts, investors can enter into agreements that allow them to buy or sell Bitcoin at predetermined prices within specific timeframes.

Increasing Investor Exposure to Risk-Defined Derivative Instruments

The growing demand for Bitcoin Options Contracts is a clear indication that market investors are seeking ways to manage their risks and participate in the cryptocurrency market. These risk-defined derivative instruments offer several advantages, including the ability to limit potential losses and hedge against unfavorable market movements. By using options contracts, investors can make informed decisions and implement strategies that align with their risk tolerance and investment objectives.

Call Options: Betting on a Bull Market

One type of Bitcoin Options Contract is the call option. When an investor purchases a call option, they gain the right, but not the obligation, to buy Bitcoin at a specific price (known as the strike price) within a predetermined timeframe. Call options are popular among investors who anticipate a bullish market, as they enable them to profit from the potential price appreciation of Bitcoin.

For example, if an investor purchases a call option with a strike price of $30,000 and the price of Bitcoin rises to $50,000 within the specified timeframe, they can exercise their option and buy Bitcoin at the lower strike price, subsequently selling it at the higher market price. This allows them to profit from the price difference.

Put Options: Hedging Against Market Volatility

On the other hand, put options provide investors with the right, but not the obligation, to sell Bitcoin at a specific price within a predetermined timeframe. Put options are typically utilized by investors who anticipate a bearish market or wish to hedge against potential price declines. By purchasing put options, investors can protect themselves from substantial losses in the event of a market downturn.

For instance, if an investor purchases a put option with a strike price of $60,000 and the price of Bitcoin drops to $50,000 within the specified timeframe, they can exercise their option and sell Bitcoin at the higher strike price, thereby avoiding losses associated with the price decline.

Navigating the Bitcoin Options Market

With the increasing demand for Bitcoin Options Contracts, investors must navigate this complex market effectively. It is essential to consider factors such as implied volatility, time decay, and the overall market sentiment. Conducting thorough research, staying informed about market trends, and seeking professional advice can significantly enhance an investor’s decision-making process.

Moreover, investors must carefully evaluate their risk tolerance and investment goals before engaging in options trading. Understanding the potential risks and rewards associated with Bitcoin Options Contracts is crucial to making informed investment choices.