BitMEX Founder Arthur Hayes Predicts Bitcoin’s Performance Amidst War and Rising Energy Prices

In a recent article published by BitMEX founder Arthur Hayes, he delves into the intriguing dynamics between Bitcoin, war, and rising energy prices. Contrary to the initial market reaction that tends to favor a sell-off of Bitcoin in such turbulent times, Hayes asserts that Bitcoin stands resilient and may outperform traditional assets like bonds during war periods.

Buy the Dip Mentality: Hayes’ Confidence in Bitcoin’s Long-Term Potential

Hayes, known for his insights in the cryptocurrency space, expresses a “buy the dip” mentality even if Bitcoin faces an initial period of weakness in response to geopolitical tensions and escalating energy costs. According to Hayes, his confidence in Bitcoin’s long-term potential remains unshaken, and he sees the temporary downturn as an opportunity to accumulate more of the digital asset.

Bitcoin vs. Bonds: A Comparative Analysis

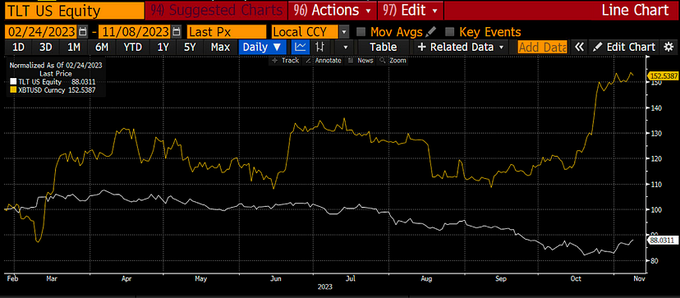

Hayes draws attention to the performance of Bitcoin in comparison to traditional long-term US Treasury bonds, specifically citing the TLT ETF. Since the onset of the Ukraine/Russia war, the TLT ETF has witnessed a significant 12% decline, while Bitcoin has surged by an impressive 52%. This stark contrast challenges conventional wisdom and prompts a reevaluation of Bitcoin’s role in times of global uncertainty.

Hayes sheds light on the factors that contribute to Bitcoin’s resilience amidst geopolitical turmoil. One key aspect highlighted is Bitcoin’s decentralized nature, making it less susceptible to government interference and economic instability. Additionally, the limited supply of Bitcoin, capped at 21 million, positions it as a hedge against inflation, a feature that becomes particularly appealing during war times.

The Potential Impact on Market Dynamics: Bitcoin’s Role in Economic Shifts

As Bitcoin continues to gain attention as a potential safe haven asset, its performance during geopolitical events becomes increasingly relevant. Hayes’ perspective prompts a broader conversation about how Bitcoin could influence market dynamics and potentially reshape traditional views on investment strategies during turbulent times.