- BlockFi begins temporary asset distribution via Coinbase in July

- Allocation will be processed in batches over several months

- Eligible customers to receive email notifications from BlockFi

- Non-US customers currently excluded due to regulatory issues

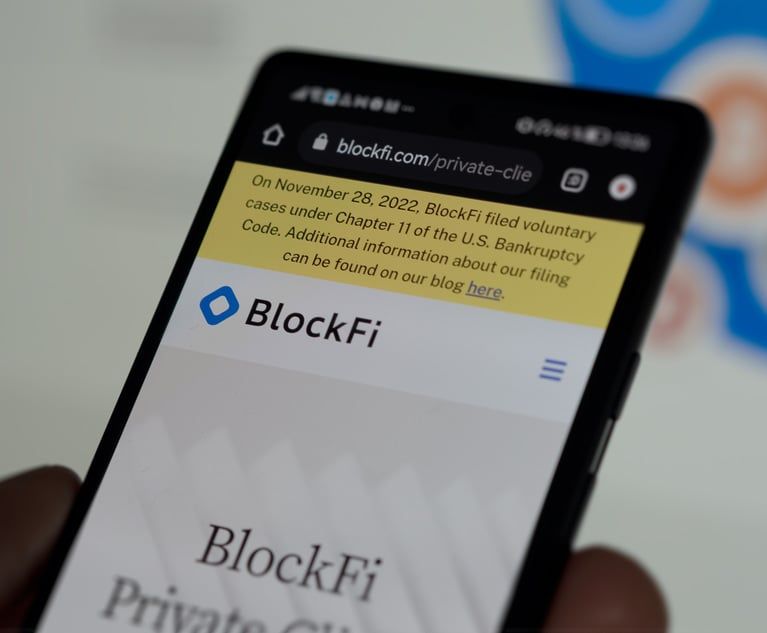

BlockFi’s Post-Bankruptcy Move: Asset Distribution Kicks Off

BlockFi, the bankrupt cryptocurrency lending platform, has announced its plan to begin distributing crypto assets through Coinbase starting in July. This marks the first significant step in addressing the financial aftermath of its bankruptcy.

Batched Allocations Over Several Months

The distribution process will be executed in batches, ensuring a structured and orderly release of assets to eligible customers. Over the next few months, customers will see their assets gradually reappear in their accounts. BlockFi is managing the process meticulously to maintain transparency and compliance with regulatory standards.

Notifications for Eligible Customers

To streamline the communication, BlockFi will notify eligible customers through email. These notifications will detail the allocation specifics, ensuring that customers are informed every step of the way. BlockFi’s approach aims to rebuild trust and clarity after the tumultuous period following its bankruptcy declaration.

Regulatory Hurdles for Non-US Customers

However, there is a notable exclusion in this distribution plan. Due to stringent regulatory requirements, non-US customers are currently ineligible to receive their assets. This limitation underscores the complex global regulatory environment that crypto firms must navigate.

Challenges for International Customers

For non-US customers, the wait continues. Regulatory challenges mean that these customers will not receive their assets in this initial distribution phase. BlockFi has acknowledged this issue and is likely working on solutions to address the regulatory barriers in the future.