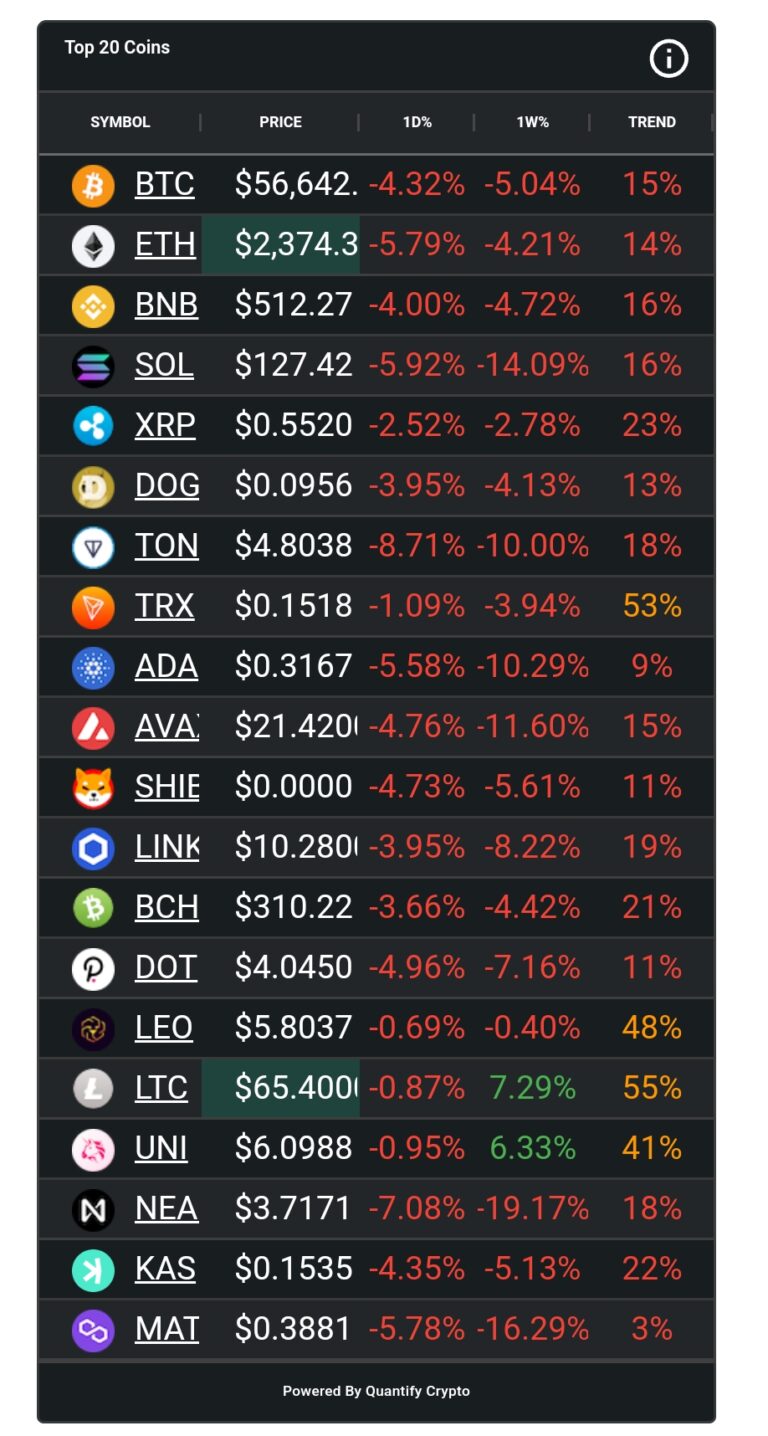

- Bitcoin drops 4.32%, extending its weekly loss to 5.04%.

- Ethereum plummets 5.79% in a single day, driving more sell-offs.

- Altcoins face even sharper declines, with Solana falling over 14% in one week.

- Despite the bloodbath, a few tokens show signs of resilience, like Litecoin with a 7.29% weekly gain.

Crypto Markets Spiral as Investors Face Uncertainty

The cryptocurrency market is experiencing significant turbulence, with major coins facing substantial losses across the board. Bitcoin, the world’s leading digital asset, has taken a sharp hit, falling 4.32% in just 24 hours to settle at $56,642. This continues a downward trend, with Bitcoin losing over 5% in the past week.

Ethereum, the second-largest cryptocurrency by market capitalization, has faced an even steeper decline. ETH has dropped 5.79% in just a day, bringing its price to $2,374.3. This has intensified investor fears, as Ethereum continues to suffer, shedding 4.21% over the week.

Other leading cryptocurrencies like Binance Coin (BNB) and Solana (SOL) are also bleeding red. BNB saw a 4.00% drop over the last day, continuing its decline of 4.72% over the week. Meanwhile, Solana is feeling the heat with a sharp 5.92% drop in the past 24 hours, adding up to a 14.09% loss in the past seven days. These numbers highlight the brutal conditions for altcoins, which are facing immense selling pressure as the market continues to weaken.

Litecoin Shines Amid the Downtrend

Despite the overwhelmingly negative sentiment, there are a few bright spots in the market. Litecoin (LTC), for example, has been a surprising outperformer. While its daily performance shows a minimal 0.87% dip, LTC has posted a remarkable 7.29% gain over the past week, standing at $65.40. Litecoin’s resilience has caught the attention of investors looking for safer options during this downturn. The coin’s ability to buck the overall trend could be attributed to upcoming network developments and growing adoption in payment systems.

Another notable standout is Uniswap (UNI), which managed to climb 6.33% over the past week despite a modest 0.95% drop in the last 24 hours. Uniswap’s strong fundamentals and growing role in decentralized finance (DeFi) might explain its positive momentum, even as the broader market flounders.

However, these resilient tokens remain the exception rather than the rule. The majority of altcoins are suffering significant losses. For instance, NEAR Protocol (NEA) plunged 7.08% today and has lost a staggering 19.17% over the week. Similarly, Polygon (MAT) saw a severe decline, dropping 5.78% in the past 24 hours and tumbling by 16.29% over the week.

Market Sentiment and What’s Next?

The crypto market’s current volatility reflects a mix of macroeconomic uncertainties, regulatory concerns, and investor jitters. Rising interest rates, inflation fears, and tightening monetary policies are contributing to the risk-off sentiment. Additionally, the looming specter of stricter regulations in key markets like the United States and Europe is keeping traders on edge.

This week’s crash has also dampened the market’s overall sentiment. Fear and uncertainty have taken hold as traders seek safer investment opportunities. The ongoing decline in prices could potentially trigger more sell-offs as investors brace for further downside.

On the bright side, the resilient performance of coins like Litecoin and Uniswap suggests that select tokens may still offer opportunities for gains amid the chaos. However, the overall market direction will likely depend on broader economic conditions and potential regulatory developments in the coming weeks.

With most coins deep in the red, traders are left questioning how much further this downturn can go and when the market will find solid ground again. For now, cautious optimism is warranted, as investors wait for signs of recovery while keeping a close eye on macro trends.